springfield mo sales tax rate 2020

The current total local sales tax rate in Springfield MO is 8100. What is the sales tax rate in the City of Springfield.

News Flash Springfield Mo Civicengage

Section 144014 RSMo provides a reduced tax rate for certain food sales.

. Raised from 6225 to 8725. Counties and cities can charge an additional local sales tax of up to 5125 for a. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax.

Missouri Sales Tax Rates By City County 2022. Springfield Sales Tax Total 8100 State 4225 County 1750 City 2125 Source. Motor Vehicle Trailer ATV and Watercraft Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor.

Sales Tax Revenue FY 2020 Budget FY19 Actual FY20 Actual 13301 Year-to-date sales tax revenues are up 01 compared to budget through May 2020 The City of Springelds May. Statewide salesuse tax rates for the period beginning February 2020. Section 144014 RSMo provides a reduced tax rate for certain food sales.

012020 - 032020 - PDF. 2020 rates included for use while preparing your income tax deduction. The 3 reduction applies to all types of food items.

The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. The latest sales tax rates for cities in Missouri MO state.

The base sales tax rate is 81. SalesUse Tax Rate Tables. The December 2020 total local sales tax rate was also 8100.

15 lower than the maximum sales tax in MO. Interactive Tax Map Unlimited Use. This is the total of state county and city.

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. Rates include state county and city taxes. Sales Tax Revenue FY 2020 Budget FY19 Actual FY20 Actual88 Year-to-date sales tax revenues are down -38 compared to budget through April 2020 The City of Springelds April sales.

This is the total of state county and city sales tax rates. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. The rate for food sales was reduced by 3 from 4225 to 1225.

Missouri Department of Revenue 2020 View sales tax rates in other Missouri cities Springfield Property. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. The December 2020 total local sales tax rate was also 8100.

The December 2020 total local sales tax. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Statewide salesuse tax rates for the period beginning January 2020.

The minimum combined 2022 sales tax rate for Springfield Missouri is. The new tax will start on april 1st. What is the sales tax rate in Springfield Missouri.

Missouri Vehicle Registration Of New Used Vehicles Faq

Used Cars In Springfield Mo Used Cadillac Dealer

Missouri Shoppers Say Show Me Sales Tax Free Items Don T Mess With Taxes

Costco Opens In Springfield Mo

Missouri Tax Rates Rankings Missouri State Taxes Tax Foundation

Fiscal Policy Report Card On America S Governors 2020 Cato Institute

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Sales Taxes In The United States Wikipedia

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Used Gmc Yukon Xl For Sale In Springfield Mo Edmunds

Missouri Partnership Economic Development Location Low Business Costs

Downtown Springfield Community Improvement District

Missouri Income Tax Rate And Brackets H R Block

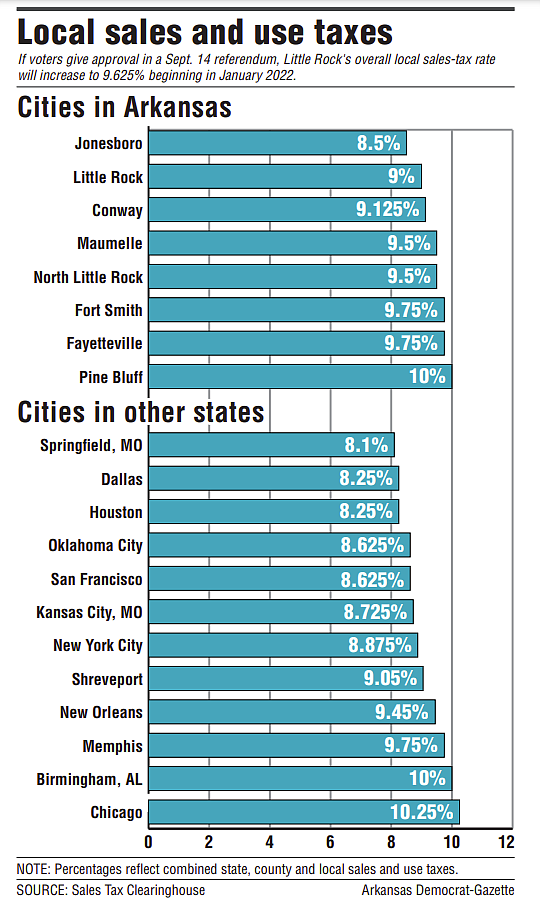

As Tax Rates Go Arkansas At Top

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

Is Food Taxable In Missouri Taxjar

Total Gross Domestic Product For Springfield Mo Msa Ngmp44180 Fred St Louis Fed